One of the hottest buzzwords in the 21st century is ‘Billionaire’. Because of the tech boom, their number has increased exponentially in recent years, so has their reputation and fans. This increasing fan base and admiration have led people to follow in their footsteps without much thought. And when such a thoughtless following leads the public to the share market, we know what happens due to such craze.

And that’s what happened in Wall Street recently. When famous investors and executives like Chamath Palihapitiya, Kevin Hartz, Andrew Paradise, Bill Ackman started investing in SPACs, this unpopular practice became the new trend and investors started pouring money based on whether these people are in the particular SPAC or not. And if that was not already enough, celebrities like Basketball Hall of Famer Shaquille O’Neal, Golden State Warriors player Stephen Curry, tennis champion Serena Williams, former pro baseball player Alex Rodriguez joined in, hyping the craze even further.

Now to get into the depths of it, let me tell you what a SPAC is and why it has become so popular in recent years.

What is SPAC? SPAC, or Special Purpose Acquisition Company, is founded with the sole intention of acquiring a private company. Just the way it sounds, SPACs have no business operations. But that’s not the only interesting point. SPACs raise funds through an IPO and the investors of the IPO are unaware of which company the SPAC management is planning to buy.

Now a simple question arises- Why would the investors invest in such companies? The answer is the halo effect. Generally, the founders of SPACs are expert investors or experts in certain fields with a great reputation. This gives the investors a sense of security and confidence. So, on the surface, the success of this IPO depends more on the SPAC founder than the actual business deal.

However, there is a lot more in the process. You didn’t think these institutional investors would throw such huge chunks of money in the name of the trust? Definitely not. The SPACs are generally given two years to acquire a company. In this due time, the IPO money is kept in an interest-bearing trust fund. In case, a deal is not made, the investors will get their money back with interest minus underwriting and other costs.

Another important question is- What’s in there for the private companies? It’s the exemption from the IPO process. The IPO process is full of formalities like underwriters, prospectus and other filings. In SPAC, the company has to just merge and they will be public. In addition, the early investors will have a way to liquidate their position due to the SPAC deal. And the juiciest benefit is the 20% or more hike in sale price than private equity transactions. And due to the massive boom in recent years, SPACs can start a bidding war to gain the most lucrative outcome.

The Recent Frenzy: If we have to choose the face of such frenzy, that would be Chamath Palihapitiya. The self-proclaimed next Warren Buffett, with a Twitter follower of 1.5 million, is the owner of 6 SPACs -Virgin Galactic, Clover Health, Opendoor Technologies and three other undisclosed companies. He started with Virgin Galactic in 2017 and that is also the year SPAC’s demand started rising. Then hedge fund manager Bill Ackman also raised a $4 billion SPAC.

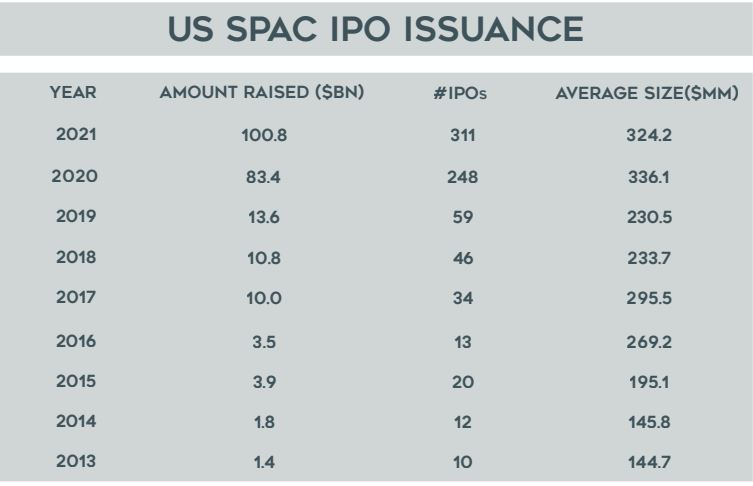

Celebrities also joined this SPAC party, the demands of the SPACs started soaring like crazy. SPACs raised $100 billion just in the first quarter of 2021. It wouldn’t be an exaggeration at all to call this a ‘SPAC quarter’.

The Bust: History repeats itself is a proverb that matches the stock market more than anything. Whenever a craze happens, investors feel left out and without digging deeper or thinking about the long-term consequences, they go with the flow. The housing market was one example and now SPAC is the current one.

After such a crazy quarter, SEC issued an accounting guideline that would classify SPAC warrants as liabilities instead of equity instruments. And such change will propel SPACs to reevaluate their financials in 10-Ks and 10-Qs for the value of warrants each quarter. After such declaration, the CNBC SPAC Post Deal Index fell record-high, so did the expectation of the SPAC followers.

Along with that came the SPAC star’s poor performance. Virgin Galactic’s price fell by 50% after Chamath himself dumped $213 million worth of shares. It speculated that it happened due to the uncertain future and low demand for space tourism. Other SPACs of Chamath’s also fell a lot compared to the SPAC index. The plummeting price of his portfolio also choked the SPAC investors’ expectations, prompting them to rethink their decisions. But they should have done it before getting into it.

The SPAC incident has shown us another classic herd-instinct incident. The regulator’s new guidelines and SPAC star’s fall show us the vulnerability of the SPAC market. But that does not mean SPAC will go out of the picture. Bill Gates said there are too many low-quality SPACs, however, he is holding the high-quality ones. And that’s the point. Rather than going with surroundings, investors should focus on SPACs that have real and long-term value. Now we will see investors and experts looking into the hindsight and warning people of the pitfalls of SPACs. And surprisingly there are lots of supporters for them as well.

After pondering about this incident and its criticism, a famous Buffett quote strikes my head-

“In the business world, the rearview mirror is always clearer than the windshield.”