Why Bangladesh Should Introduce Options Derivatives In Its Finacial Market.

He thinks that even if Bangladesh comes out ahead of this crisis as a winner, over the next few months, stocks might face a bloodbath due to this looming uncertainty. All he wants is some protection from this risk and to come out of this crisis unscathed.

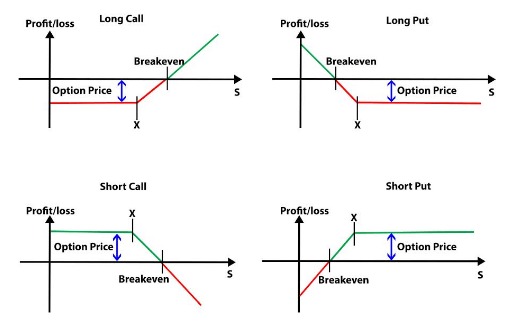

There are financial derivative instruments that do exactly that in the US and European financial markets. They are called options which are derivative instruments that allow their holders a right to buy (call option) or sell (put option) a specific underlying at a specified price within a given time frame.

Now, that’s a mouthful. An example would clarify it better. Our Abdus Salam, worried that he will lose money in his Square Pharma stock, may decide to purchase a Put Options contract to protect his investment.

How would this work?

So, Square Pharma stock is trading for around Tk 210 a piece[1] and Abdus Salam doesn’t want his stock to go below Tk 200. Abdus Salam could purchase Put Option contracts for 6 months at a strike price of Tk 200 from an options dealer. And if the stock actually falls below Tk 200 within that period, he would be covered by his Put Option as the dealer would bear the loss and Abdus Salam can sleep peacefully knowing that his investment is safe during this crisis period.

Now, why would the options dealer bear this loss?

Basically, the dealer would charge a premium sort of like an insurance premium to Abdus Salam for bearing this risk and would profit if the stock doesn’t fall below Tk 200 within this period.

This is not the only way stock options work, there is Call Option which allows our investor to buy a stock at a specific price which allows our investor to buy a stock at a specified price.

Suppose, Salam thinks that Beximco Pharma stock would jump from its current price (around Tk 150[2]) to a much higher price of around Tk 165 within the next three months because of an upcoming product line. He could buy a Call Option for Tk 155, which would give him the right to buy that stock for that price even if the stock is trading at a much higher price. Thus, he might profit heftily.

This is not the only way options work and there are many more ways our venerable Abdus Salam could transform his return potential by altering his return profile by changing his risk profile using strategies like Covered Calls, Spreads, Strangles etc. Strategies that cannot be explained by this simple blog.

Source: https://blog.quantinsti.com/basics-options-trading/

So, even if Abdus Salam wants to, he cannot do that.

Options trading access is especially necessary for insurance companies, pension and gratuity funds and institutional investors that want to ensure that they follow a consistent risk and return strategy.

Options trading is already an essential part of the US stock market with 9.87 billion contracts traded in 2021 alone (Lane, 2022) which is influencing the overall US stock market greatly. This represents hundreds of billions of dollars worth of movement of the underlying stocks.

Even though options trading has been the domain of institutional investors, retail traders are also getting in on the action. The unusual stock movement of GME, AMC and other similar stocks has been largely a result of retail traders’ using options to influence the stock price movement (Evangelos, Eleftheria, & Polydoros, 2021).

Questions may arise as to the viability of options trading in Bangladesh given the liquidity and knowledge of retail traders in Bangladesh. But options trading is largely an institutional operation for big banks, insurance firms, pension funds and the like, so the knowledge factor hardly comes into play.

For liquidity consideration, DSE market turnover didn’t fall below Tk 272 crore and had a peak of Tk 2800 crore (Babu, 2022). This indicates more than enough liquidity for options trading to occur, especially for the blue-chip stocks and DSEX as a whole. The Chicago Board Options Exchange (CBOE) started trading call options with only 16 stocks in 1973 (Hull, 2015) and now this has turned into a humongous operation with hundreds of billions of dollars worth of underlying being traded.

Having an options market in Bangladesh would attract foreign investors, create swaths of high-paying jobs, increase the market depth of Bangladesh’s stock market and most importantly, create a sector in our financial market that would help retirees and insurance users by helping institutional investors achieve their desired return.

The current time of heightened market reactiveness and stress is probably the best time for the regulatory authorities to look into the viability of introducing options market in Bangladesh.

Further Reading: Options, Futures, And Other Derivatives by John C. Hull

References

Babu, M. U. (2022, December 06). DSE turnover again shrinks to a 20-month low. Retrieved from The Business Standard: https://www.tbsnews.net/economy/stocks/dse-turnover-again-shrinks-20-month-low-546694

Evangelos, D. V., Eleftheria, B., & Polydoros, T. (2021). Explaining Gamestop Short Squeeze using Ιntraday Data and Google Searches. Journal of Prediction Markets, 2,3.

Hull, J. C. (2015). Options, Futures And Other Derivatives. Toronto: PEARSON.

Lane, R. (2022, August 19). U.S. options data breakdowns challenge trading desks. Retrieved from Refinitiv: https://www.refinitiv.com/perspectives/future-of-investing-trading/u-s-options-data-breakdowns-challenge-trading-desks/#:~:text=Options%20trading%20volumes%20soared%2032.2,5.84%20billion%20contracts%20have%20traded.